Mid-Year Market Update – Roseville-Sacramento Real Estate Market

Nobody has a crystal ball, but everybody wants to know what the real estate market will do This year. This is my 24th year being an active full-time realtor so why not throw my opinion out! LOL.

On the big picture, inflation has slowed down which has helped reduce interest rates to around 6.8 - 7%. Moving forward, if inflation continues to cools down the "Feds" are looking at reducing the prime rate. However, I doubt rates will drop below 6%. I would consider that to be a good rate! Over the past 40 years of interest rates tracking this is about "average". Super low rates (2-4% are unlikely to come back anytime in the near future.)

The Market Is Always Changing

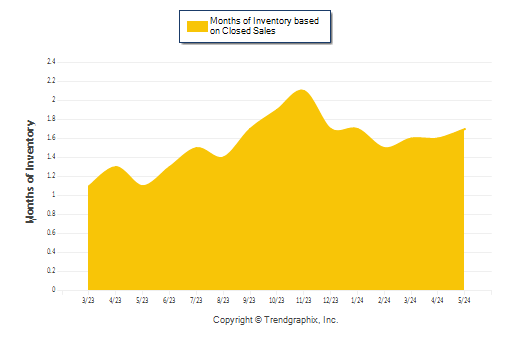

As the wise saying goes; “Change is the only constant in life,” and this holds true for real estate. In the last half of 2023 we had a little more dramatic changes when mortgage interest rates went from 3.5% to 8%. Buyers paused and resale home sales slowed down dramatically by as much as 60% in some areas.

MOVING TO A BALANCED MARKET

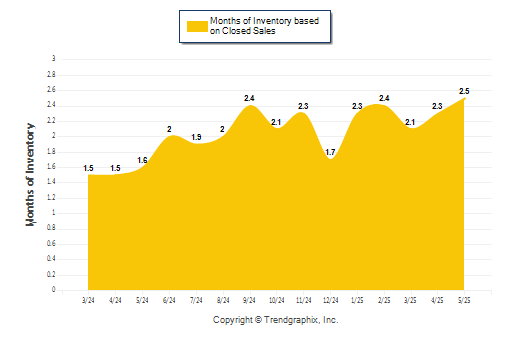

Since 2020 and even earlier inventory has been at record lows. Then rates jumped in the fall of 2023. Buyers pulled back and homes sales slowed dramatically. As it now stands inventory has been growing and the market is beginning to return to a "balanced market". (3-5mos. of inventory.) In a “balanced” market both buyers and sellers have room to negotiate without anyone gaining an upper hand. Nonetheless, the number of actual homes sold, (not including new home sales) is down by 40%. Sellers are hunkered down in their homes with super low rates and buyers are hoping rates and home values fall. Thus making it more affordable to buy a home. Nonetheless, life does continue, and people must get on with their lives. Whether it be a job relocation, a growing family needing more space, or divorce and death. This is creating opportunities for buyers and sellers.

Sellers Need to be Realistic.

The days of Seller's getting multiple offers on their home and selling at thousands over asking price are gone. Yes, multiple offers still occur for well-priced homes that have been updated or move-in ready. Pricing your home is going to be key to getting the best offer on your property in the shortest period. Sellers should consider offering buyer concessions such as a credit for closing costs or interest rate buy down especially for first-time home buyers. Sellers should also plan to do cosmetic repairs and freshen their home up with fresh paint etc. before putting their home on the market. Price your home at the last and best recent comp or even slightly lower if you want to sell it fast.

Buyers Will Have More Control

Yes, you will have higher interest rates, but the focus should be on your monthly payment. Although the market has slowed down, we still have low inventory on the market. Less than 2-month supply of homes for sale is low. In a balanced market 3–5-month supply is typical. Buyers will have time to view multiple properties and, in some cases, negotiate for certain concessions. There are more items to negotiate than just price. Homes are staying on the market longer now on average now around 30 days on market, (DOM) and it is not unusual to see homes on the market for 90 days!!

Things to watch for the rest of 2025.

- Interest Rates: High interest rates will restrict the flow of potential buyers simply because of affordability issues. Recently there are signs that inflation has slowed and hopefully we have avoided a recession as well. Rates have already dropped. I recommend that buyers get approved at today's rate and then start looking and if rates drop then, you will be able to get the home you want. FOCUS on your monthly payment/budget not so much on timing the market.

- Inventory – The number of homes on the market is slowly increasing but as the chart below shows, inventory has been climbing for the past year or so. Increased inventory is better for everyone.

3. Existing Home Values: Home values peaked in the spring of 2023. Since then, they have pulled back slightly. I expect values to hold and decrease slightly but if you are waiting for a crash do not count on it. Homeowners have thousands of dollars of equity in their homes and are very unlikely to sell for much less. They will simply wait and sell later if they do not have to.

4. Volume Of Sales: The number of homes sold last year was 40% lower than in 2023. Simply because most homeowners have huge equity in their homes and ultra-low mortgages at 2 & 3%. This reduces inventory, and this will continue for a few years to come.

5. New Home Sales – New construction continues to do well since we continue to see immigration from the bay area and other parts of the state. Affordability continues to be the problem. The average cost of a new home starts at $650,000 before any upgrades. Construction materials and the process have shot up due to inflation.

In summary, at Mid-year 2025 the market will slowly improve if rates come down this fall. Buyers are the key. As soon as interest rates drop below 6.5%, we will see buyers returning to the market. Home values are pulling back slightly 3-5%, and there is no significant reason to expect homes values to plunge. Seller's simply have to much equity to walk away from their largest asset.

The local real estate market will move to a "balanced market" Both buyers and sellers will have room to “talk.” I will provide updates when the time comes should any of these indicators should change.

Meanwhile, stay cool this summer and call/test me anytime for additional information!

Your Real Estate Advisor.

John Ecklein, Realty ONE Group/Complete

916-308-7642

john.ecklein@gmail.com